Day 355: What's BETA?

- claybaker

- Dec 21, 2017

- 3 min read

Mother's Little Helper portfolio was UP today +$755.78 (+0.09%).

Overall GAIN YTD: +$264,954.07 (+45.38%).

Our benchmark index, the S&P 500 is up +19.91% Year To Date.

http://money.cnn.com/data/markets/sandp/

There are risks and costs to action.

But they are far less than the long range risks of comfortable inaction.

- John F. Kennedy

Recently I was having a conversation about how the portfolio had performed over the course of the past year. My friend was impressed by the 45+% growth, but wondered how much risk there was in the Mother's Little Helper portfolio vs. a professionally managed portfolio or a S&P 500 index fund. Turns out there is this thing called BETA that's used to measure the risk of a security or a portfolio. A beta of less than 1 means that the security is theoretically less volatile than the market. A beta greater than 1 indicates that the security's price is theoretically more volatile than the market. For example, if a stock's beta is 1.2, it's theoretically 20% more volatile than the market. An S&P 500 index fun should have a beta of 1, because it tracks the market.

To answer this question I turned to Tip Ranks at www.tipranks.com and invested in a portfolio analysis. Below is copy of the results. TipRanks is the most comprehensive dataset of analysts, hedge fund managers, financial bloggers, and corporate insiders. The best analysts in each sector are compared and the results made available to members with the rather pricey subscription. Using this approach eliminates guessing and opinion, and best of all it eliminates me and my calculator.

Let's look at the asset allocation section first. Asset allocation is simply the percentage of stocks that we have purchased in each of the industry sectors listed below. Note that compared to the Best Performing TipRanks analysts the MLH portfolio bought less Consumer Goods stocks, Less Services, less Technology and less Financial stocks. But we invested 4% more in Healthcare.

Below is TipRanks measure of BETA or volatility of the MLH portfolio compared to the Best Performing TipRanks analysts. From this comparison we can see that the 45+% return was delivered with less risk than what these professionals would have offered their clients. In fact the MLH was only 0.09 more volatile than the S&P 500 Index.

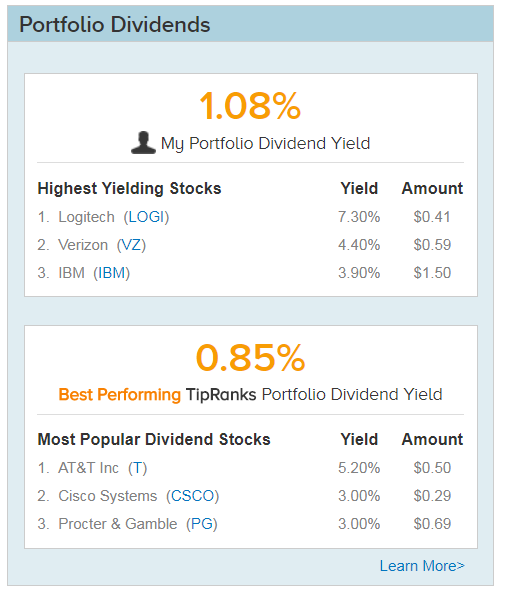

Mother's Little Helper also got a nice boost from dividend payments throughout the year. Dividend performance was 0.23% better than the Best TipRanks analysts. I'm particularly proud of this metric because delivering more cash and better growth is a big win for any investor. Two of our biggest dividend payers were also two of our biggest laggards, but the cash generation was terrific. Under normal circumstances that extra cash would have been invested or used to pay bills.

Major Holdings is where the MLH portfolio differed the most. When I made the initial purchases I allocated an equal dollar amount to each company and allowed each company's stock to perform organically. In most portfolios the stocks are allocated based on a risk factor or a market capitalization calculation. Over the course of the year each stock in the MLH portfolio has moved around and become a greater or lesser percentage of the overall portfolio. In the analysts portfolios they buy and sell to manage the size of the position. Notice that most analysts hold the same technology companies in their top holdings while MLH had a more diverse selection of healthcare, Consumer Goods, technology and industrial companies.

Overall I think we did a good job managing risk and delivering outstanding performance that more than doubled the return of the S&P 500. I'm looking forward to the final day when I can post the final results.

You don't concentrate on risks. You concentrate on results.

No risk is too great to prevent the necessary job from getting done.

-Chuck Yeager

Stay Invested

Clay Baker

Disclosure: I am personally invested long in these stocks that appear in the MLH portfolio and may purchase or sell shares within the next 72 hours. I am also invested in other stocks that do not appear in the MLH portfolio: BA, BRK.B, CELG, CSCO, CTXS, CVX, DOW, DVAX, FB, IBM, NTES, NVDA, OMER, PFE, PG, RDHL, SCHW, TBT, THO, TWX, VEEV, VZ, XLNX, XOM, Bitcoin, LiteCoin

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. This article is not intended to offer investing advice, guarantee 100% accurate predictions, or to be interpreted as providing a personal recommendation.

Comments